In the bear market, investors who hold crypto tokens are confronted with a dilemma. They are afraid of the market rebound if they sell, or losing investment returns if they hold the tokens and do nothing. In this sentiment, many people choose cryptocurrency asset management products, especially the users who have put their assets in exchanges. Therefore, the asset management products of each exchange have become the most preferred way to manage crypto assets.

Of course, these asset management products are indeed good choices when compared to the bank’s products with a 2%-4% annualized rate of return. But are they really the best options? In fact, it is not. The APY of a staking and mining product like Filet is about 30%, which is several times that of these products of banks.

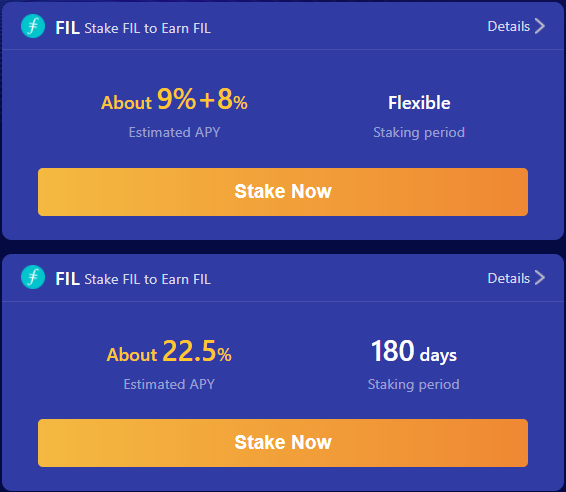

Let’s take a look at the products on Binance Earn, the world’s largest cryptocurrency exchange.

This is the APY of the products on Binance Earn. For 120-day locked products, the APY is about 10%, while for flexible savings, the APY is only 1%-3%, which is basically the same level as the products in the banks.

This is the APY of the principal guaranteed products on Binance Earn. The minimum is 1% and the maximum is only 10%, which is far less than the APY of staking and mining.

Taking Filet as an example, which mainly focuses on Filecoin staking and mining, the APY of flexible period staking is above 10%, and the APY of 360-day staking is close to 30%. Moreover, staking FIL is also risk-free, and the principal will not be lost, which is the same as the capital-guaranteed products on Binance Earn, but the APY is much higher.

Of course, the only problem with Filet is that it only focuses on Filecoin, which is not available for holders of other cryptocurrencies. Filet is a way to make money for Filecoin holders and believers. If you are holding FIL or have a firm belief in Fileocin, you may as well participate in Filet to get more.